Maxim Ivanchenko, founder and CEO of Advapay and Canopus IT describes the current state of the financial technology landscape, how Advapay is streamlining BaaS solutions to keep ahead of competition and PSD2 compliance

1. According to figures from KPMG, in 2018, global fintech investment has rocketed to a record USD 111.8 bln. Can you share some insights on the current state of play in the fintech sector, the investments made in the industry and how does Advapay fit in the grand puzzle?

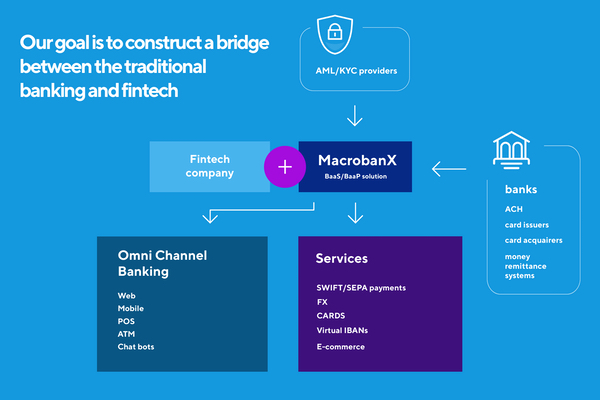

“Make us another Revolut!” — that’s the request we often receive from our clients. Revolut has become a common name, which testifies to actuality of so called neobanks. Today we observe real fintech boom. Within just a few years a number of unicorn companies have emerged — like neobanks Revolut, N26, Monzo etc. Their business model is built on no physical presence: they have no offices, branches, ATMs. Some of them have no web application, just a mobile version. Another segment is represented by blockchain projects. However crypto enthusiasm encounters strong resistance of the traditional banking system. Today, the topic of cryptobanks receded into the background, giving place to less ‘toxic’ and more understandable neobanks, which, on the one hand, can adequately compete with traditional banks, and on the other hand, observe certain ‘rules of the game’. So we help to build a bridge between traditional banking and fintech companies, ensuring comfortable interaction of both parties.

Many entrepreneurs have good ideas for a fintech startup, but not all of them understand what is needed for its launch and reaching break even within a couple of years. And you have to know quite a lot.

First, you have to clearly understand the client niche and competitive advantages in it. Second, launch of any fintech project implies obtaining licenses: you have to know nuances of regulation and be ready to the registration procedure. And, finally, IT solutions. An IT solution has to be not just up-to-date and convenient, it has to be able to quickly adapt to constantly changing market challenges.

However, that is not enough! Fintech infrastructure is quite complex. After a successful start many businesses encounter problems looking for partner banks, providers, in activities of AML department, etc. You can have an excellent engineering solution and all necessary licenses, but you will be unable to service your clients without correspondent banks.

After all, fintech is a revolutionary segment, a very dynamic one. In order to forecast what will be in high demand you have to possess good expertise, constantly monitor and study the market, be inside the processes. We release our clients from all these tasks.

2. What could you name as some operational, financial, regulatory or strategic risks for the most important players in the global fintech investments sector?

Usually operational risks are associated with the problem of AML regulation. The operational model of a fintech bank alone, when clients are identified remotely, poses risks for regulators and partner banks. This means risk of violations of legislation against money laundering. This entails financial risks: at least it results in punitive sanctions, at its worst — in loss of the banking license.

At the same time, banking regulation is on the go, and it is important to follow all the changes. Legislation regulating AML issues – 4AMLD, and the 5th version ready to be adopted – 5AMLD, as well as new requirements related to adoption and entry into force of PSD2 – Open banking, SCA, — all this changes the landscape of the traditional banking and may force the players to reconsider significantly their approach to the business model.

When it comes to strategic risks, they refer mainly to the banks that try to stay on the sidelines of the mainstream. It is the risk of losing the competitive advantage in the market and thus losing clients, preferring more flexible and modern neobanks.

3. As the deadline for PSD2 coming into force has come and passed, with industry bodies such as the European Banking Authority granting an 18-month extension to TPPs in order to ensure regulatory compliance, what are some steps that Advapay is taking to keep up with the ever-evolving market? How are the fintech solutions provided by Advapay meeting the needs of regulated payments service providers, fintechs, or neo-banks?

PSD2 is not just ‘requirements’, but also new opportunities for business. Certainly, in our IT solutions both Open Banking API and stronger authentication of clients in performing financial transactions (SCA). We ensured to all clients a transition to the new version of our platform supporting this function.

However, compliance with the regulator's requirements is a purely technical issue. More importantly, how and why these changes can be used in terms of business. In particular, Open Banking API tool allows to radically change the approach to the interaction between the bank and its partner (TPP) and/or client. A new class of players appears, as well as a new licensed activity — AIS/PIS. And we consider assistance to such new players in building their business as one of our priority tasks.

4. Your fintech software platform EpaySuite is compliant with the Regulatory Technical Standards under PSD2. What were some challenges you faced while obtaining compliance and what is some advice you can offer to fintech solution providers in this sense?

Achieving compliance with requirements PSD2 directive turned out to be a challenging problem. The thing is that the Directive defines the principles of trilateral interaction, however does not provide any clear methods for it. This has resulted in appearance of a number of independent Open API implementations different in the methods of parties’ interaction. Thus, before developing our own solution, we have carried out a wealth of research work. We studied the specifics of building Open API, adopted by regulators and fintech community in various jurisdictions.

Our solution complies with all PSD2 standards and caters for the specifics of private implementations. It allows to expand the feature set available to TPP when performing their tasks, which will contribute to flexible development of the technology in the future. It is safe to say that we designed one more version of Open API solution to offer our clients together with EpaySuite software.

As our wish to financial solution providers we suggest (and are ready to put forward an initiative) to bring the variety of Open API implementations to a certain standard format. It refers to methods of authentication of the parties, including SCA, substantive part of basic transactions for AIS and PIS services. Besides, we believe that there should be a single policy for limits and procedures for setting them. All this makes the process of Open API adaptation faster and more universal.

5. MacrobanX is Advapay’s BaaS proposition. Who is to benefit the most out of it and how does MacrobanX bridge the gap between fintechs and banks?

The standard scenario for the use of BaaS technologies looks as follows: fintech project obtains the financial license, acquires BaaS solution MacrobanX and in 1-2 months (instead of 6-12 months) starts real operation with optimal infrastructure (banking services, AML services, client onboarding, etc.).

BaaS simplifies entry to the market and helps to stay in it. A fintech company obtains not just an up-to-date IT solution that can be quickly and easily adapted to business requirements, but also operational infrastructure based on the partner bank. You do not have to invest in non-core activities and save resources, trusting IT infrastructure development and support to Advapay/MacrobanX. Besides, BaaS is a sort of technological bridge for interaction of traditional banks with fintech companies.

Implementation of BaaS technologies is beneficial for both parties: a traditional partner bank and a fintech company using bank infrastructure and offering its services to the end customer. Most significantly, the end customer will benefit from it by getting convenient, affordable and reliable banking services. Implementation of such solution will allow to attract fintech companies as customers, lowering the risk and cost level.

6. What are some predictions you are able to make at this point for the future of open banking in Europe and what are Advapay’s plans moving forward?

I am sure that Open Banking will change significantly the present-day business models of payments — first of all, towards more integrated and intelligent solutions within the single payment ecosystem. For example, Airbnb, AliPay and other services. The trend is towards cheaper, faster payments invisible for the end customer. Monopolists, such as international payment systems (Visa, MC etc.), will have to move over. Plastic cards will be gradually replaced by tokens and other virtual technologies. Various forms of distance payments will gain ground based on biometrics, artificial intelligence systems, etc. In SME banking segment, payment solutions will gain more and more importance aggregating information on banking / payment accounts and allowing to control it from a single point (single application).

We closely watch the market to not just meet the trends, but to be ahead of them. The IT market is developing rapidly, so we have to keep our eye on it — the most important skill to hold up well.

Source: www.thepaypers.com