Feature Set

Payment

accounts for

private and

corporate clients

accounts for

private and

corporate clients

ADDING FUNDS VIA

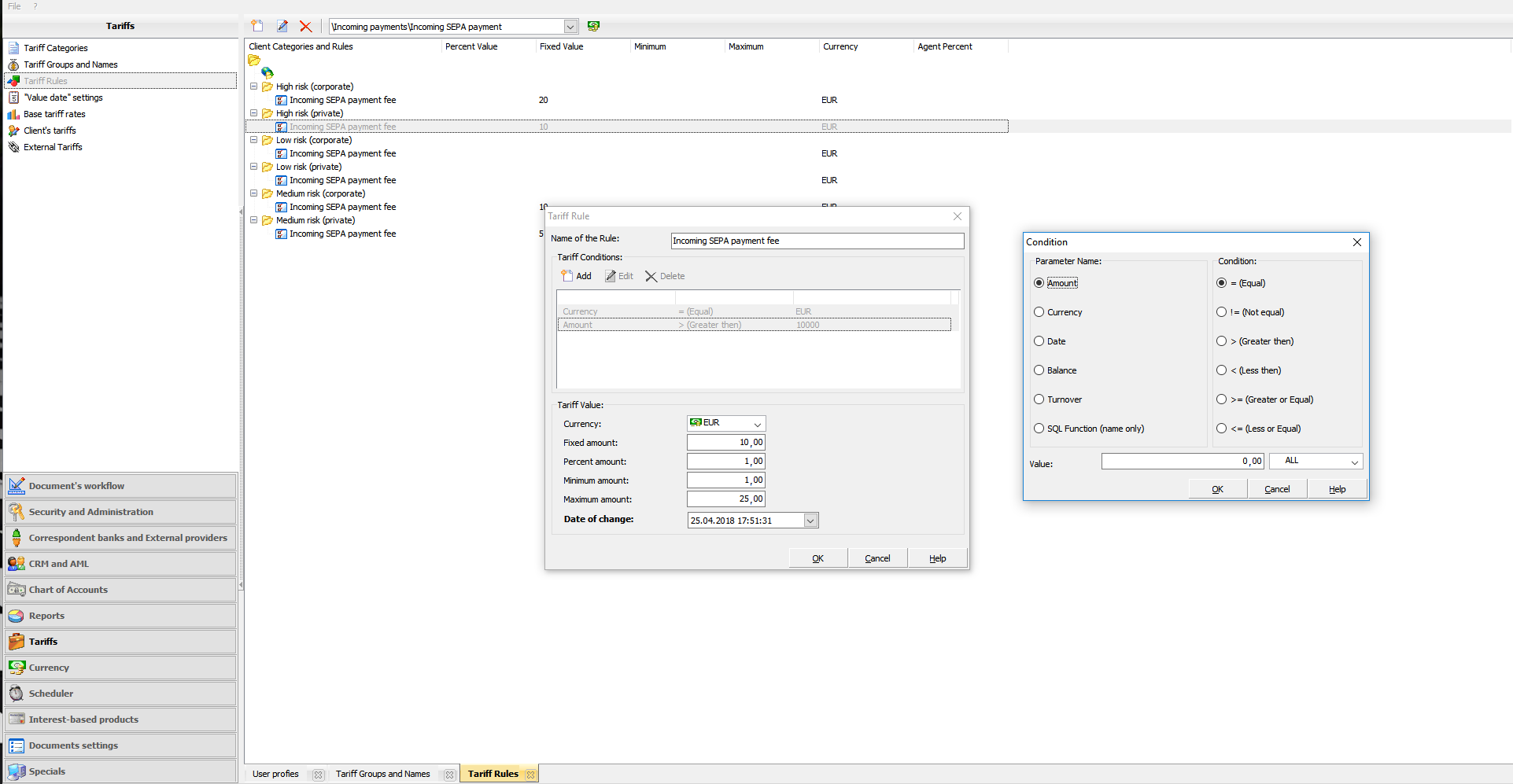

- bank remittance (SWIFT/SEPA)

- money remitters

- e-wallets

- credit / prepaid cards

- payment terminals

- own electronic cheques (vouchers)

WITHDRAWALS VIA

- bank remittance (SWIFT/SEPA)

- money remitters

- e-wallets

- credit / prepaid cards

- payment terminals

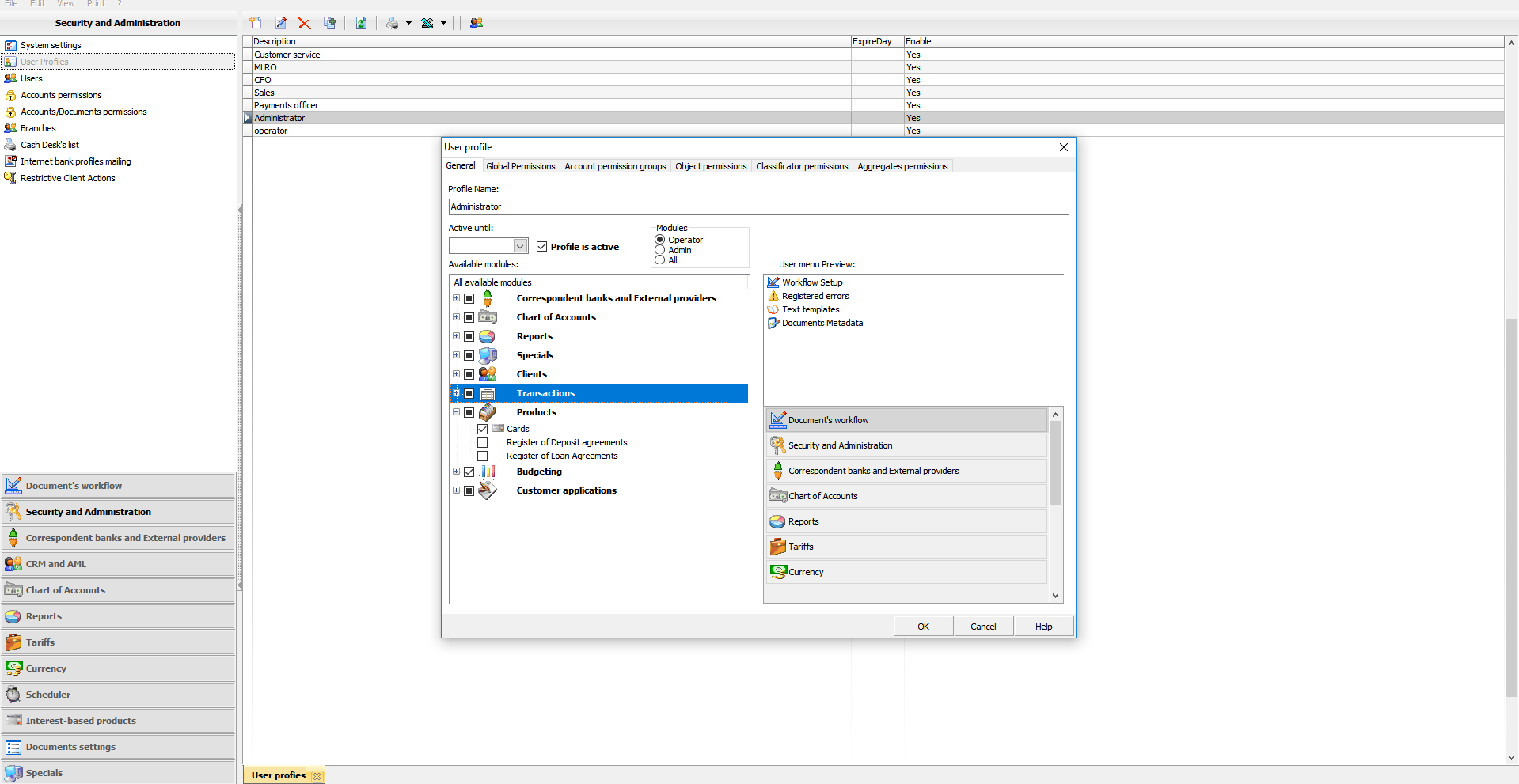

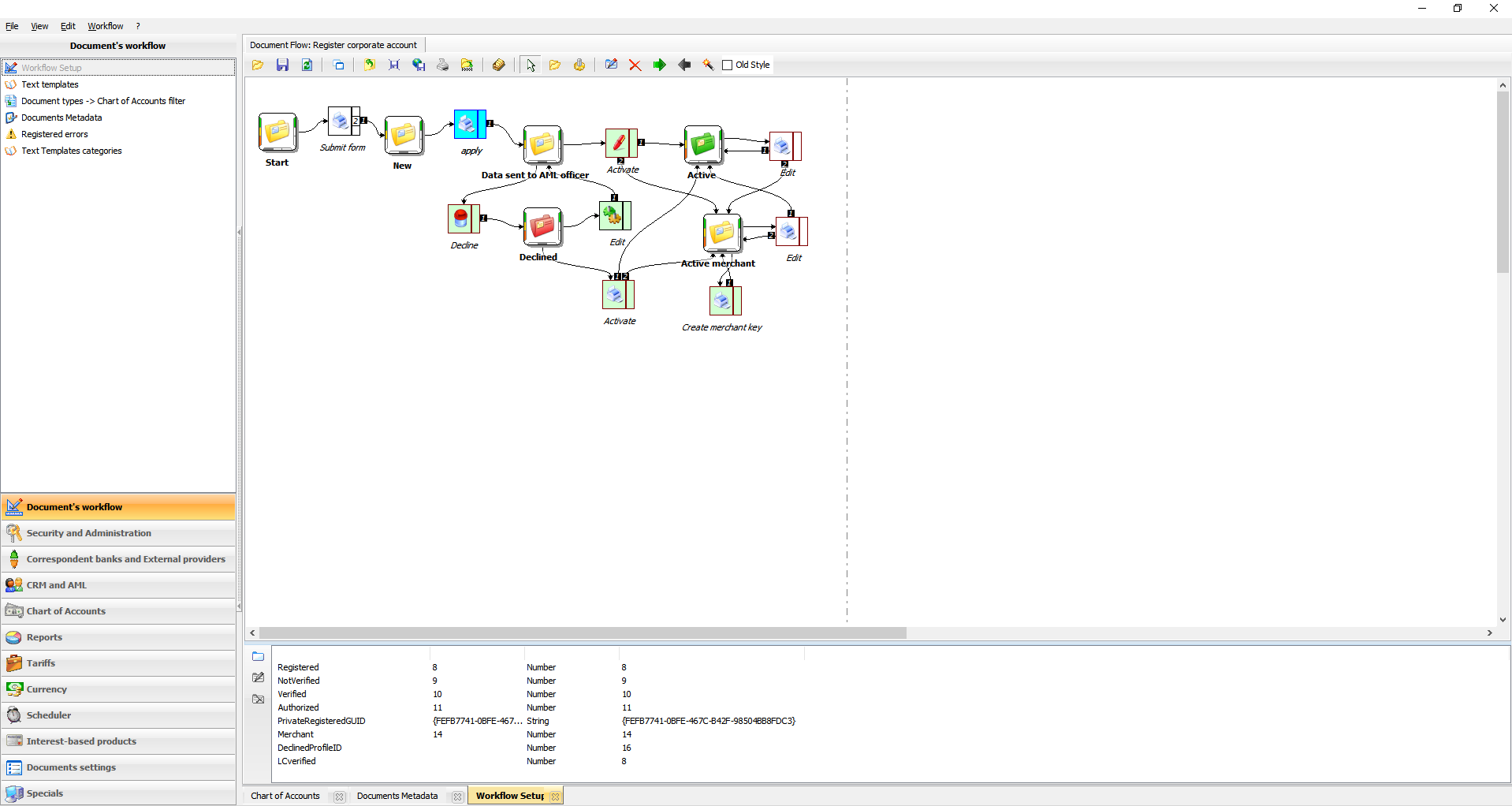

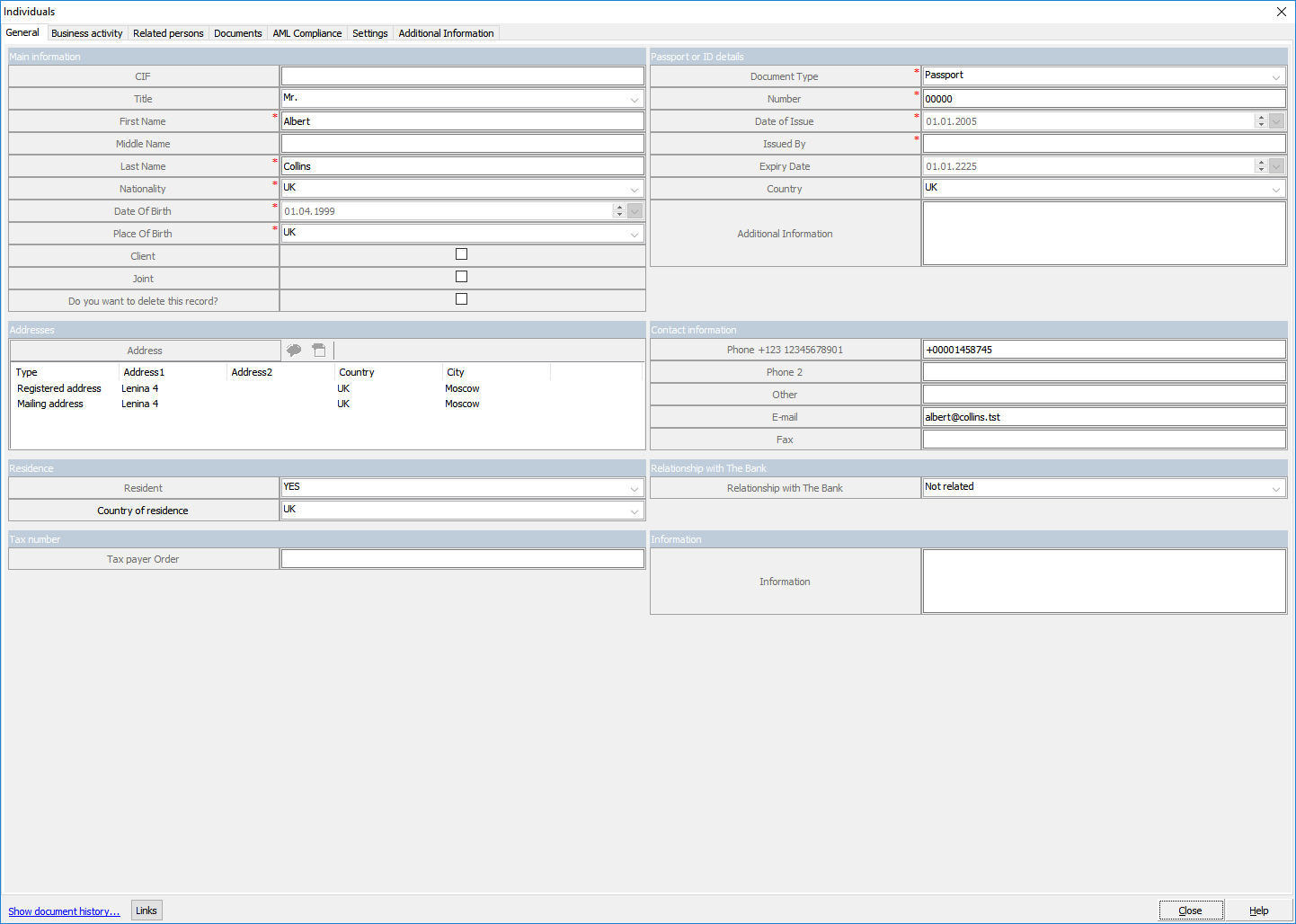

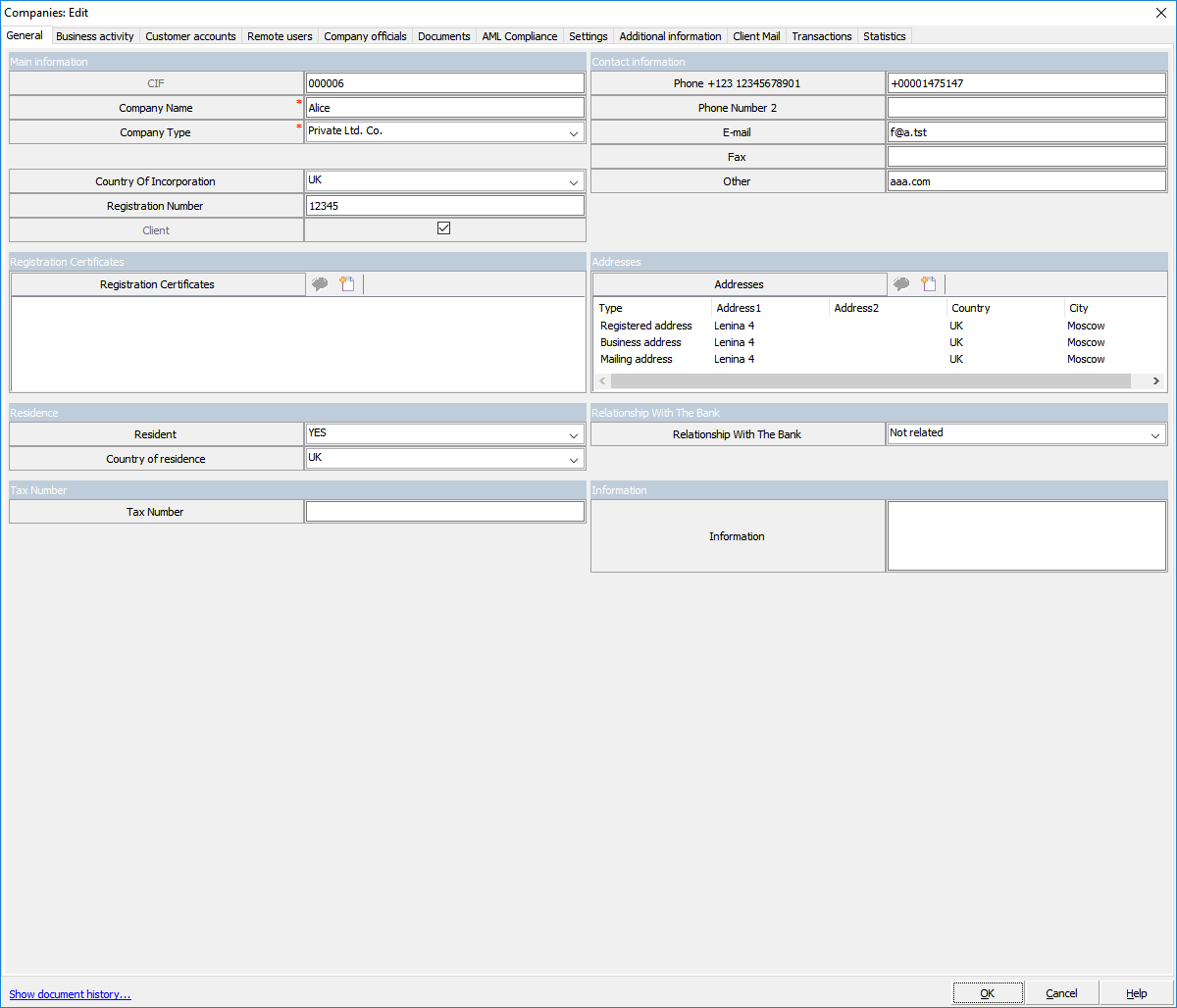

CLIENT REGISTRATION

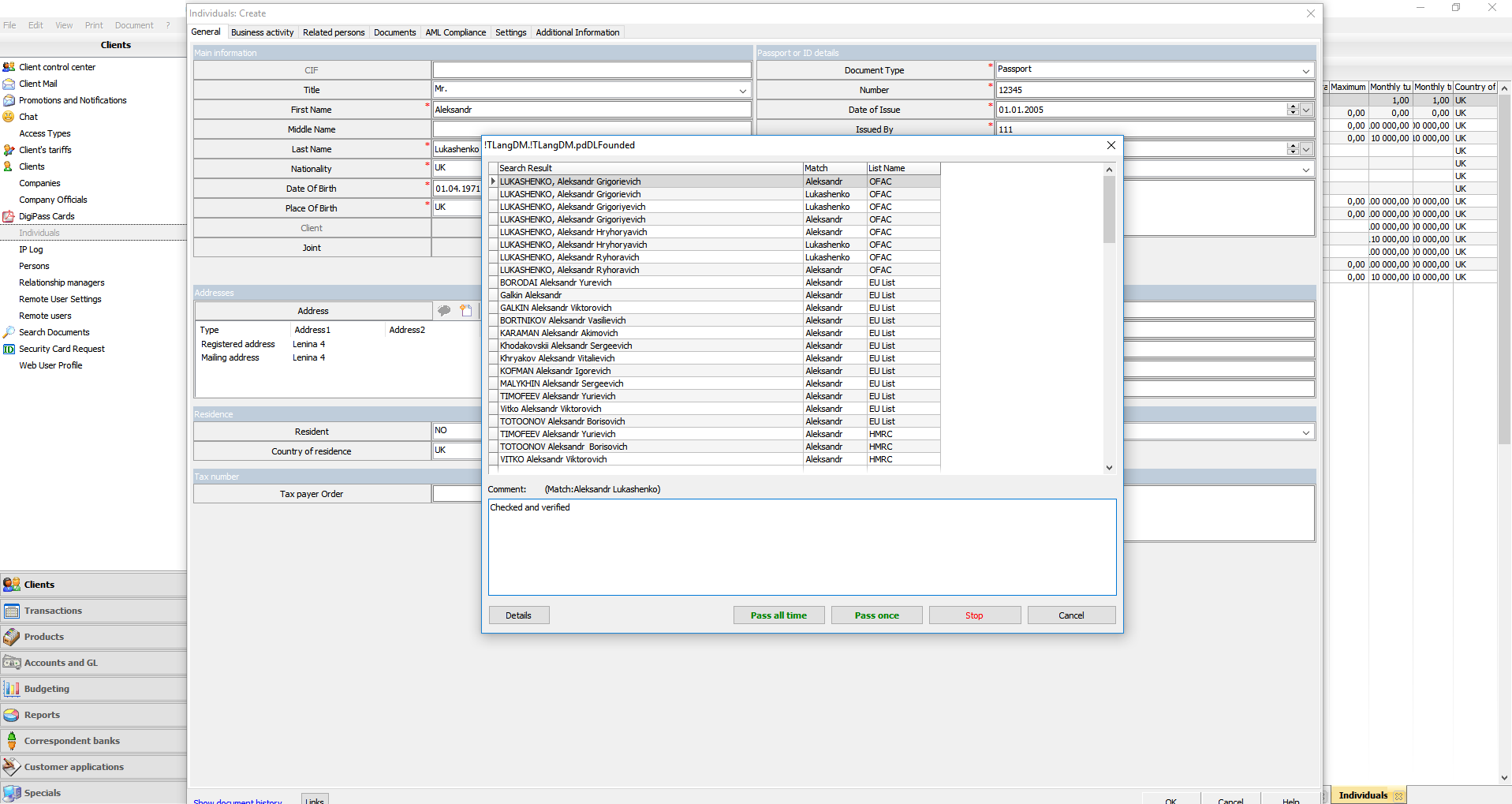

- AML/KYC procedures

- identification, document authentication

- client profiling

- payment account opening

ISSUE OF PAYMENT PRODUCTS

- co-branding cards

- virtual cards

- own electronic cheques (vouchers)

- own card programs

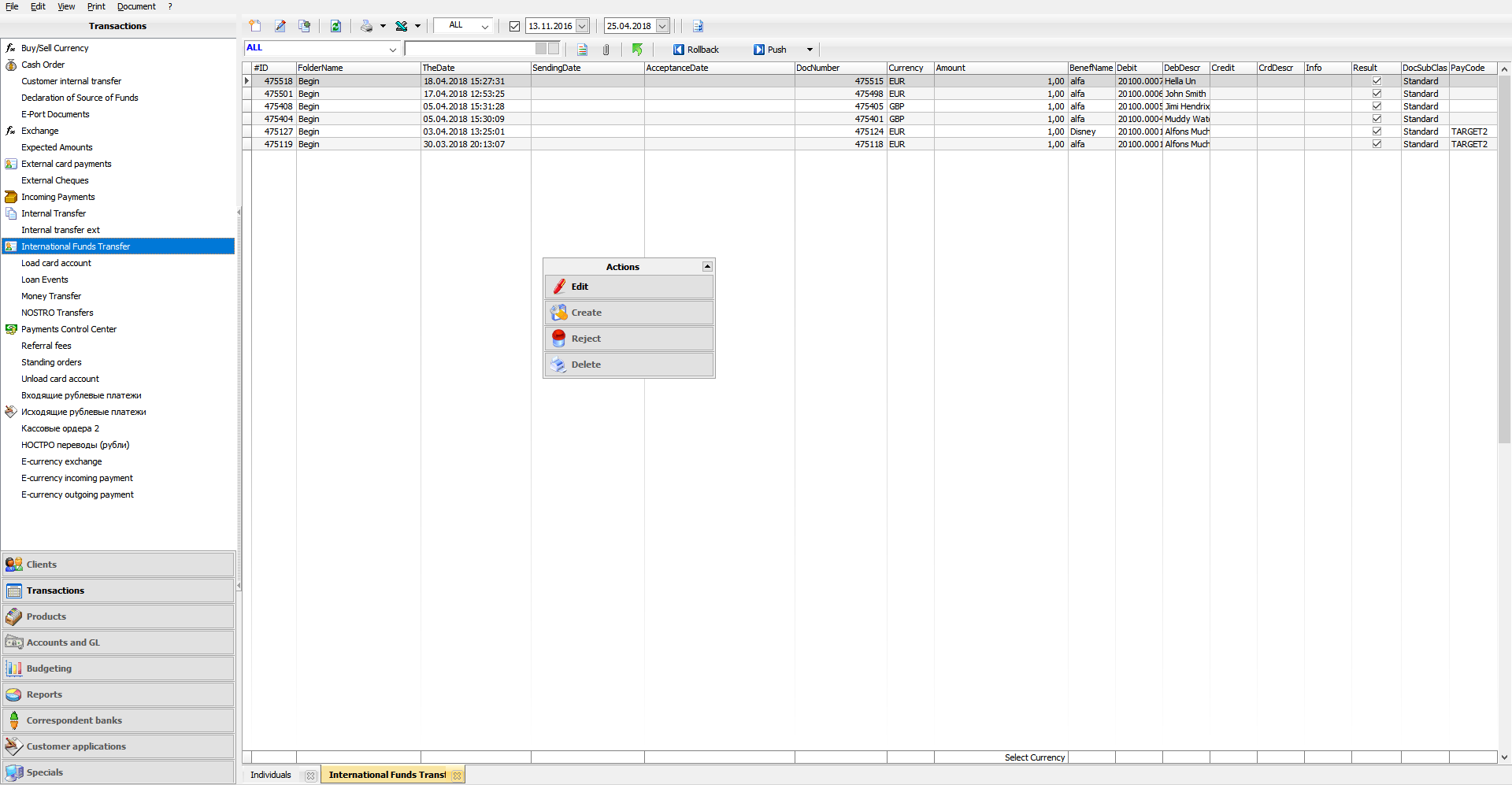

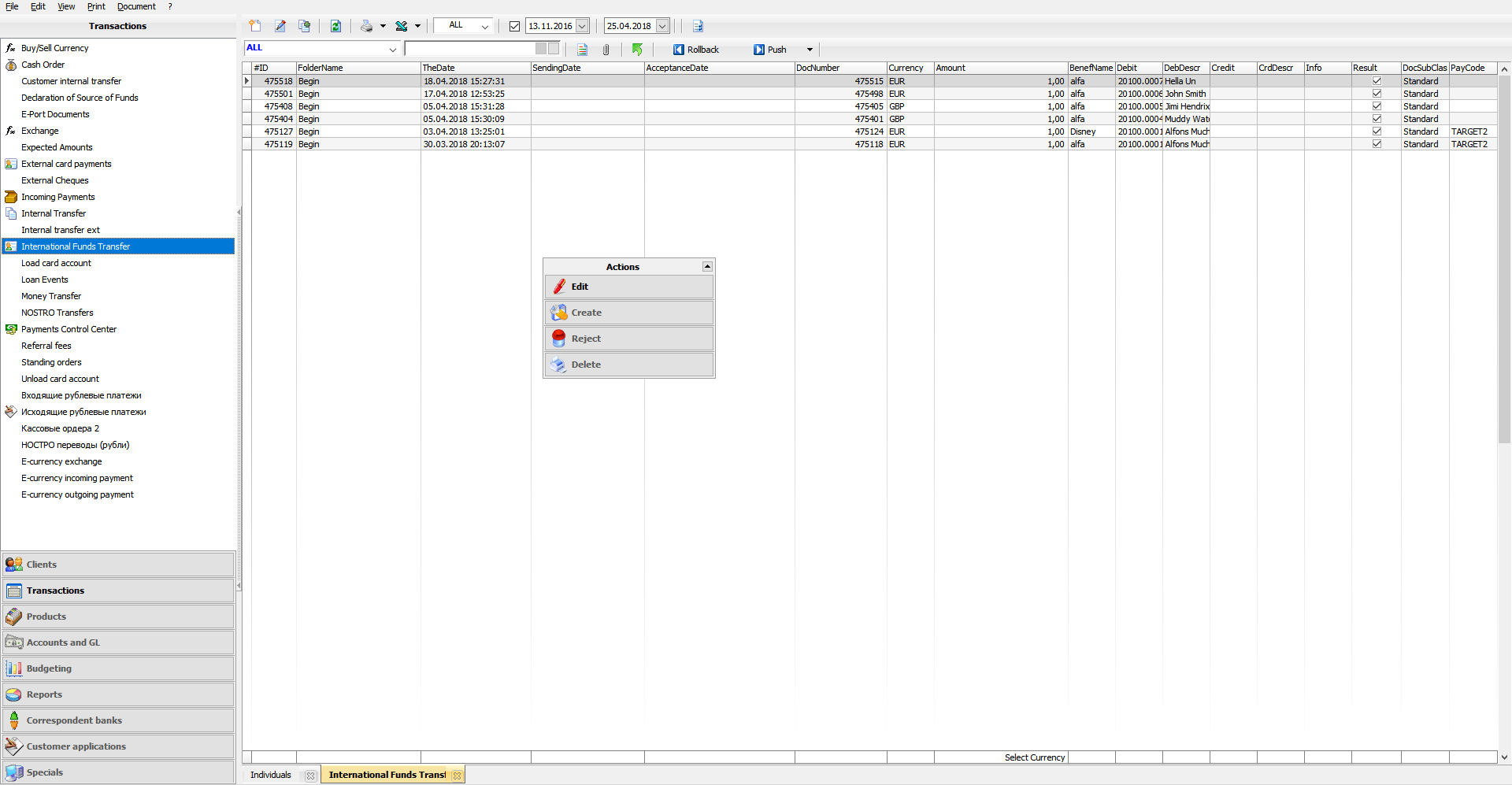

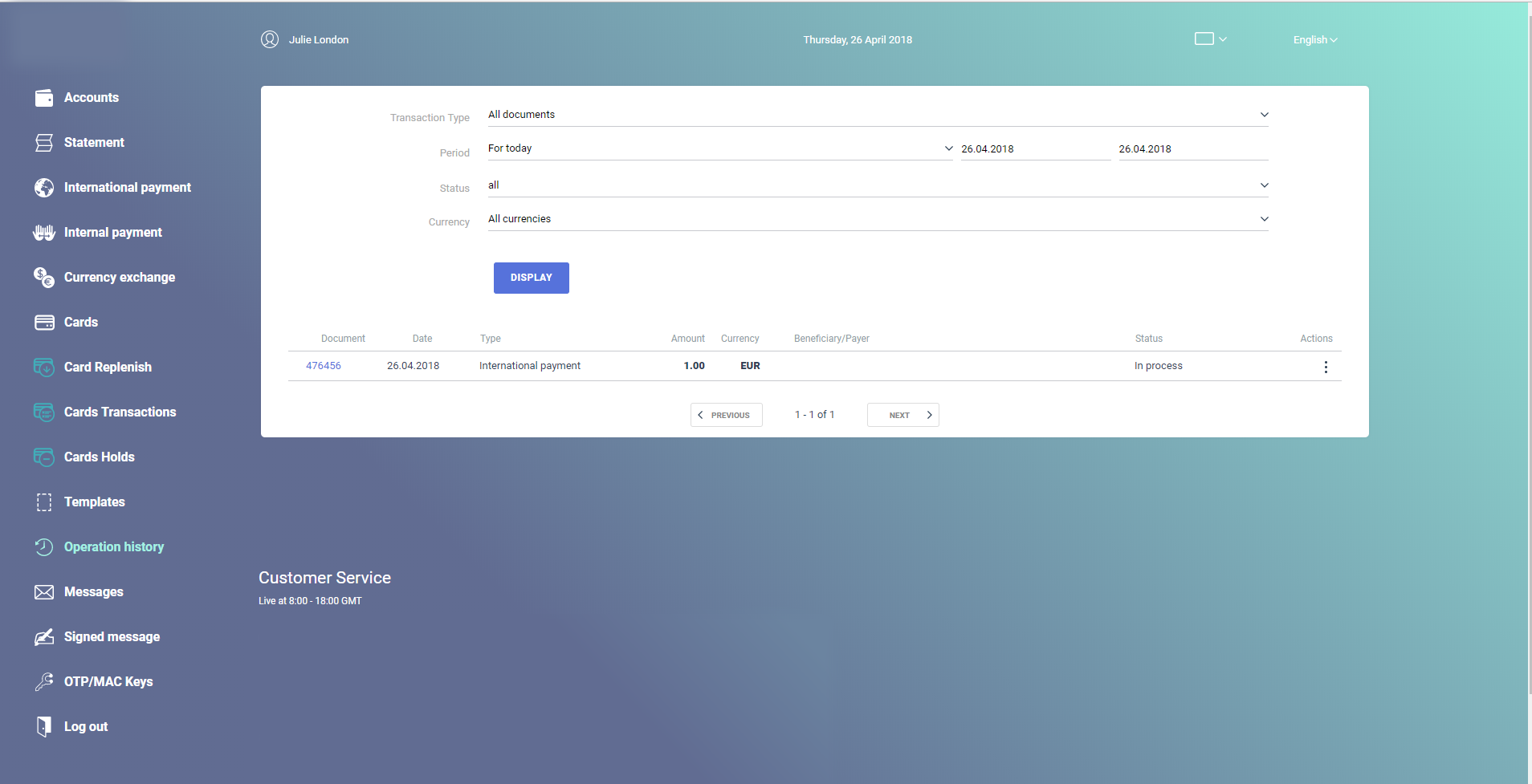

PAYMENTS

- same-client transfers

- same-system transfers

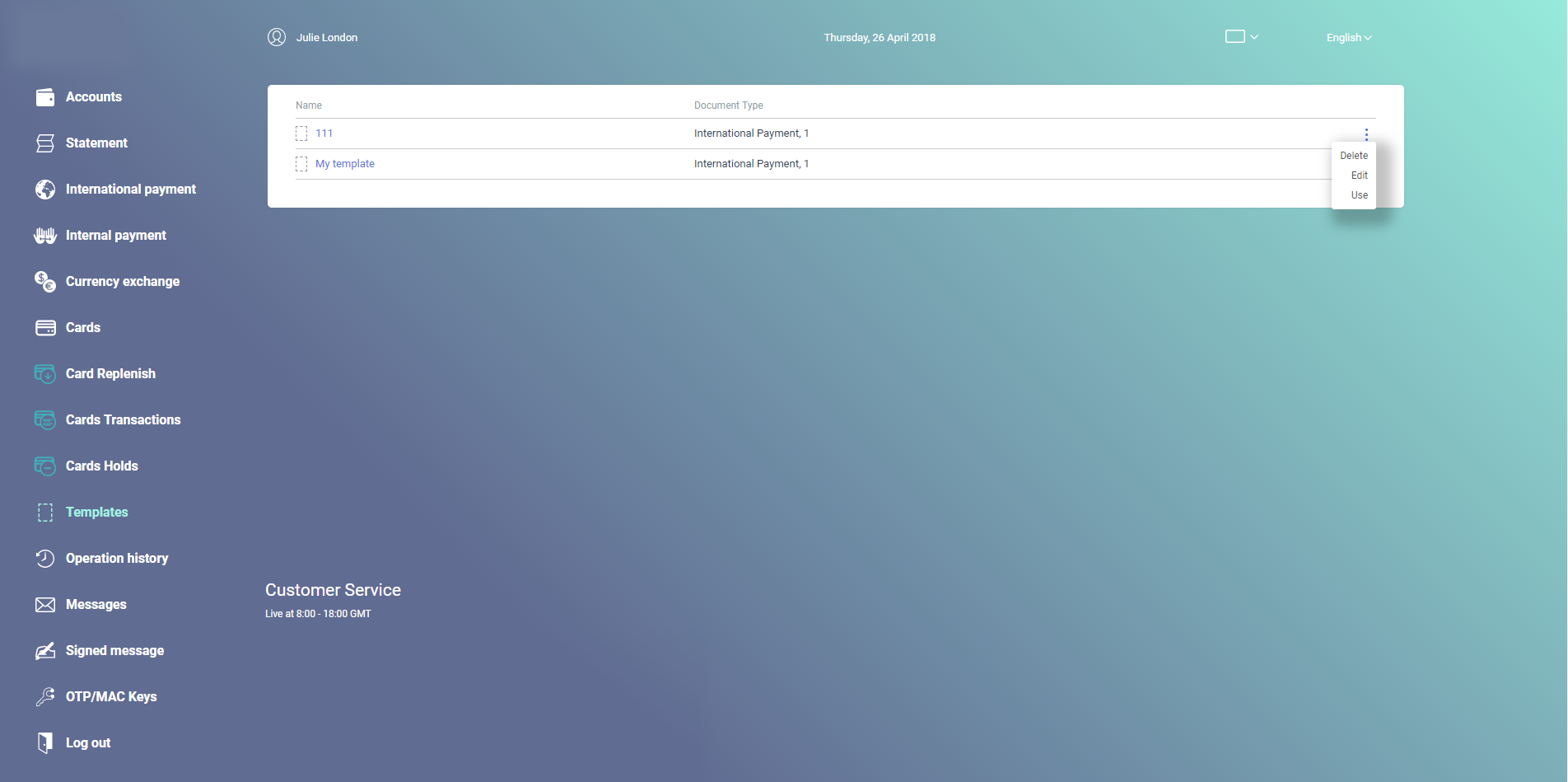

- recurrent (periodic) payments

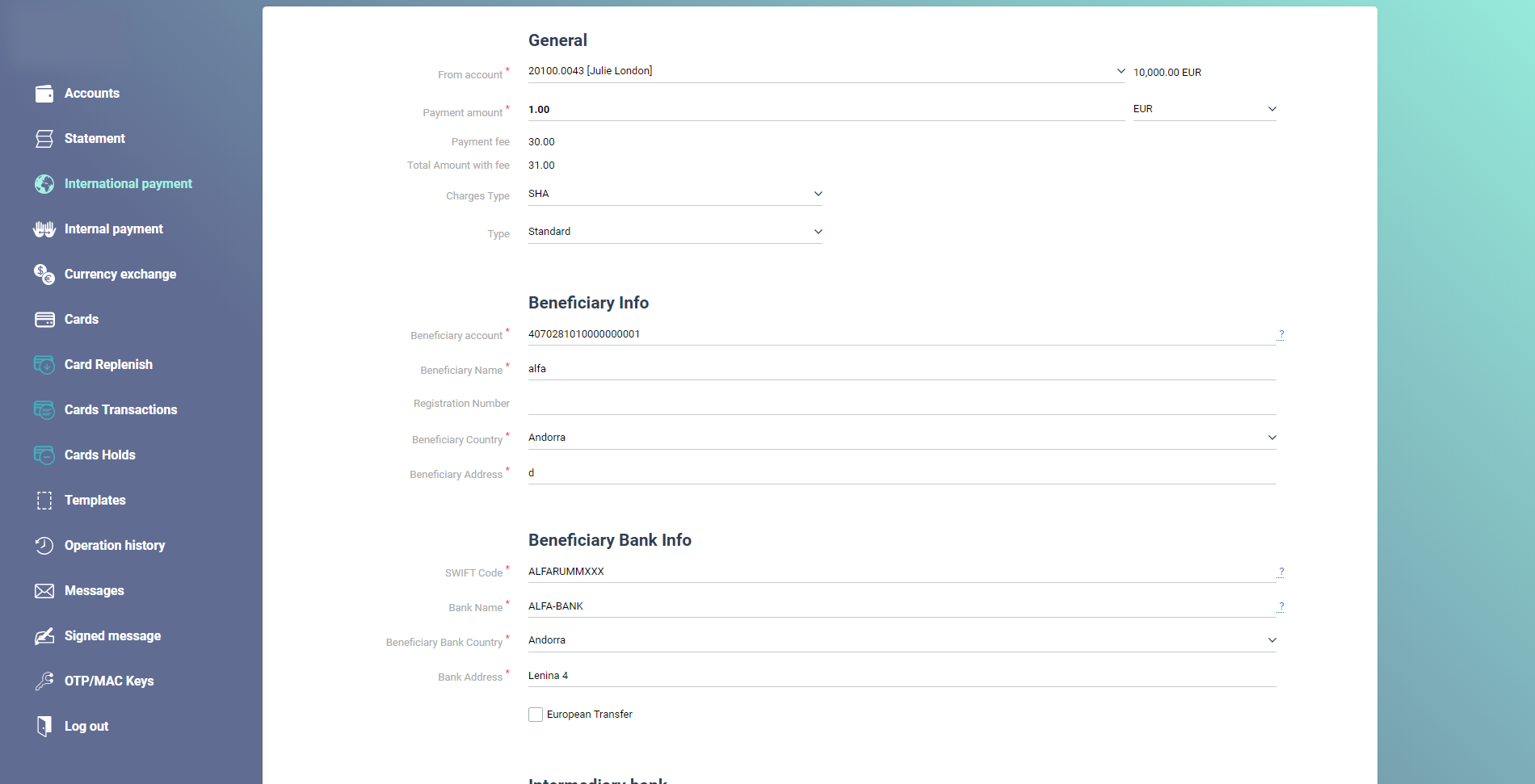

- bank remittance (SWIFT/SEPA)

- NOSTRO-transfers

- mass pay outs

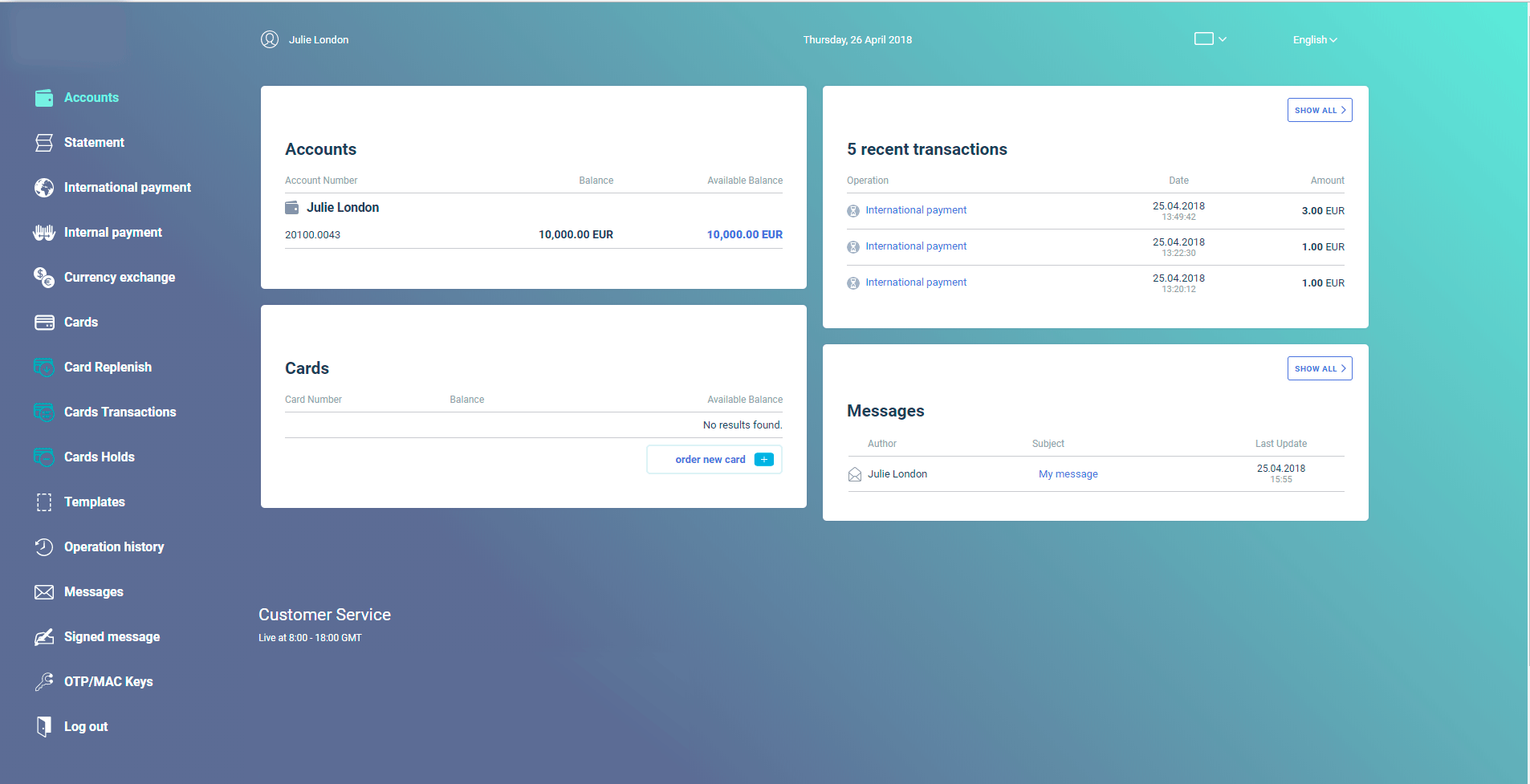

MOBILE AND INTERNET-BASED PAYMENTS

- Internet-banking,

- mobile banking

- native applications for Android and iOS systems

REMITTANCE

- retail money transfers

- via external money remitters (Unistream, Contact, etc.)

ACCEPTANCE OF PAYMENT PRODUCTS

- Internet acquiring

Advantages

Business solution configurator

Use the business solution configurator available on the desktop version of the website or fill in the form here and make a query. We will develop an individual offer for you taking into account your request in two options: with purchase of the licenses and for SAAS model

Send request

Business solution configurator

The modular architecture of Canopus products allows you to assemble only those modules that are

necessary for your business.

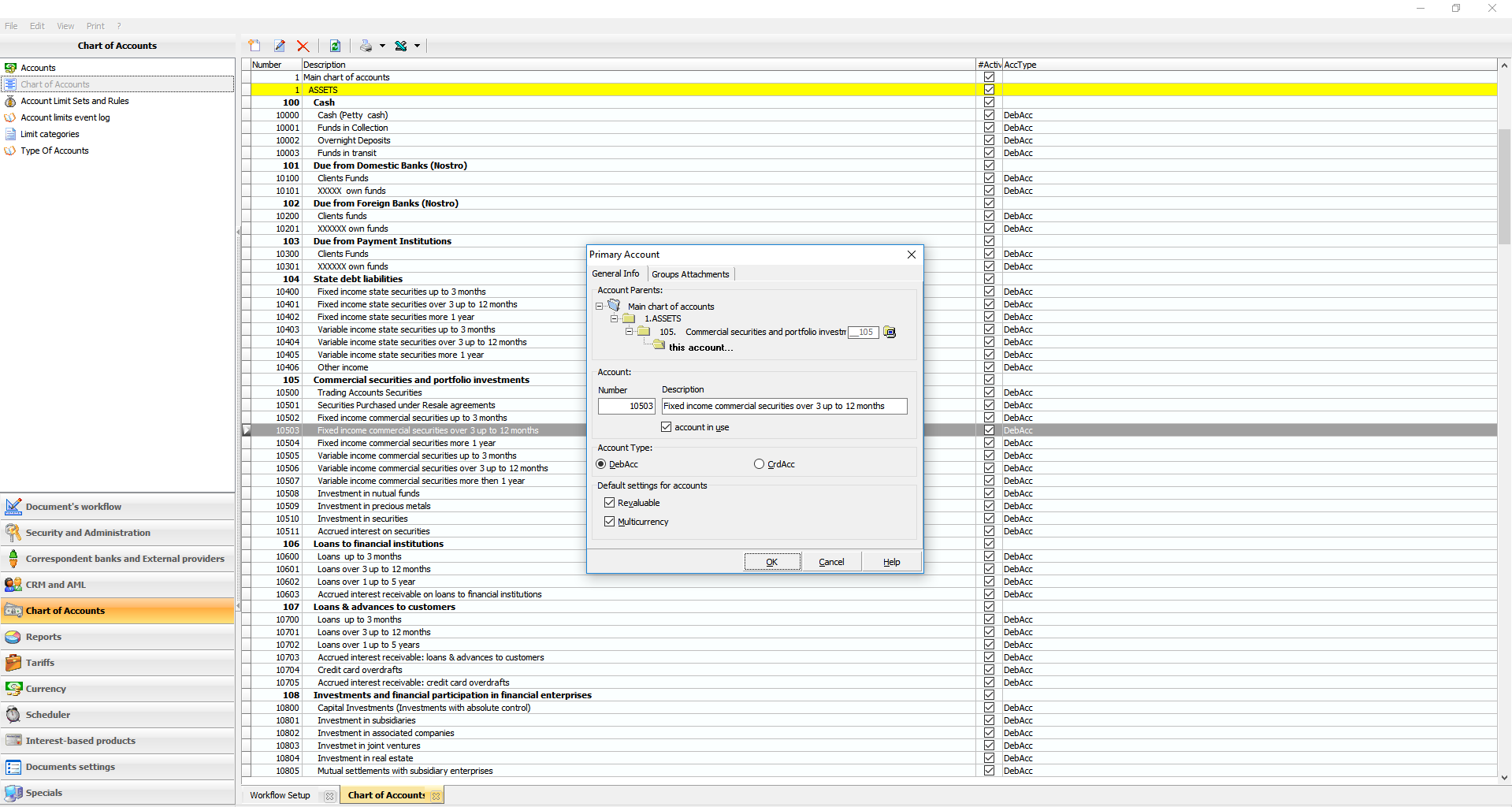

Core

AML + KYC

BANKING API

(SOAP/JSON) SMS GATEWAY

WEB-BANK

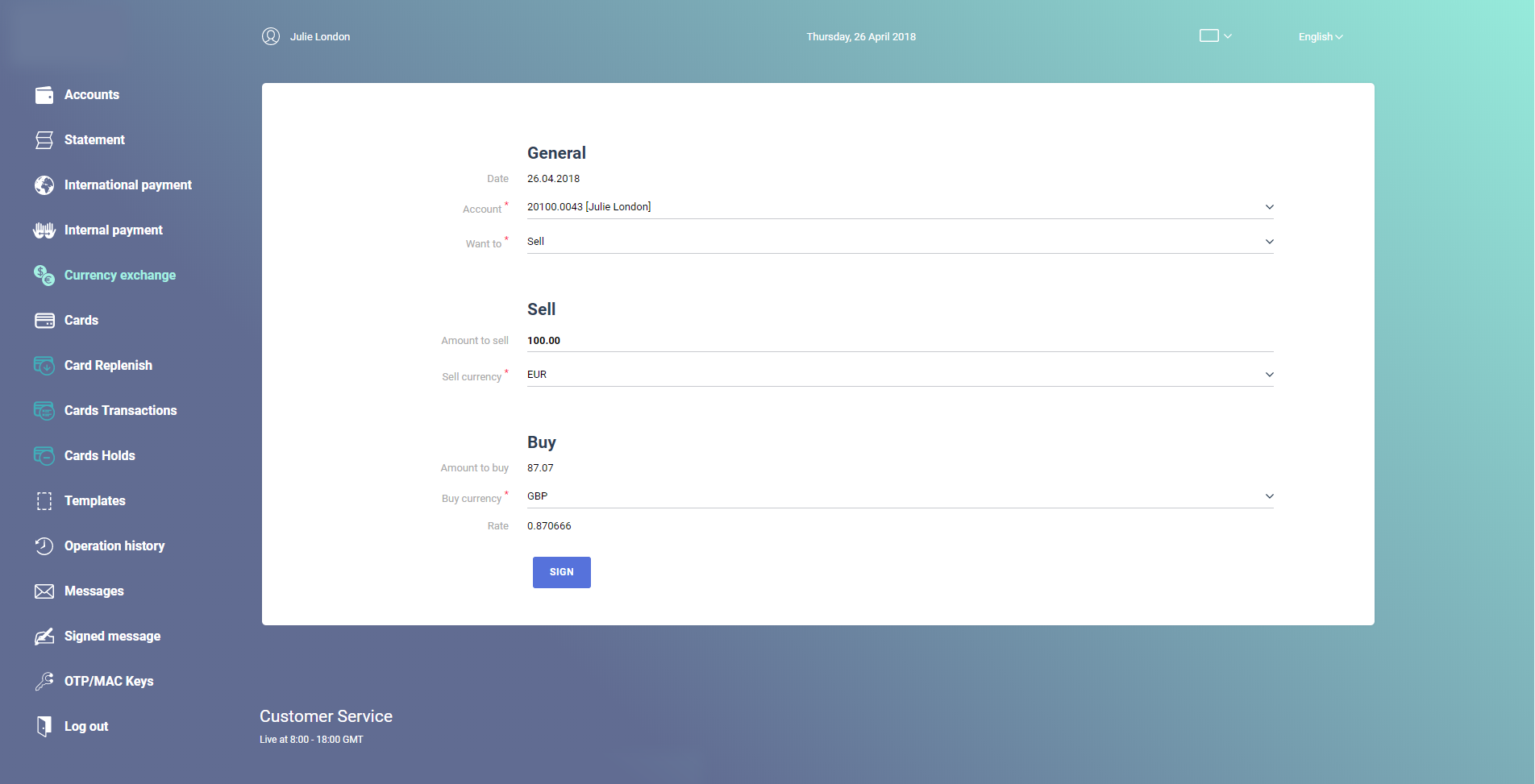

SWIFT

SEPA

AML + KYC

BANKING API

(SOAP/JSON) SMS GATEWAY

WEB-BANK

SWIFT

SEPA

CB of Lithuania

ING

InsideBusiness Payments (Czech Republic)

Rietumu

Skrill

INTEGRATION WITH BANKS AND PAYMENT SYSTEMS

MOBILE OTP/MAC GENERATOR

turn on

MOBILE

BANKING

BANKING

turn on

Cauri

CARD ACQUIRING

turn on

Decta

BANK CARDS

turn on

CARD RELOADING

turn on

Bitcoin

Ethereum

CRYPTO CURRENCIES

turn on

Unistream

REMITTANCES

turn on

OVERDRAFTS

turn on

DEPOSITS

turn on

Connect

turn on

API FOR MERCHANTS

turn on

Reviews from

our customers

You may also be interested

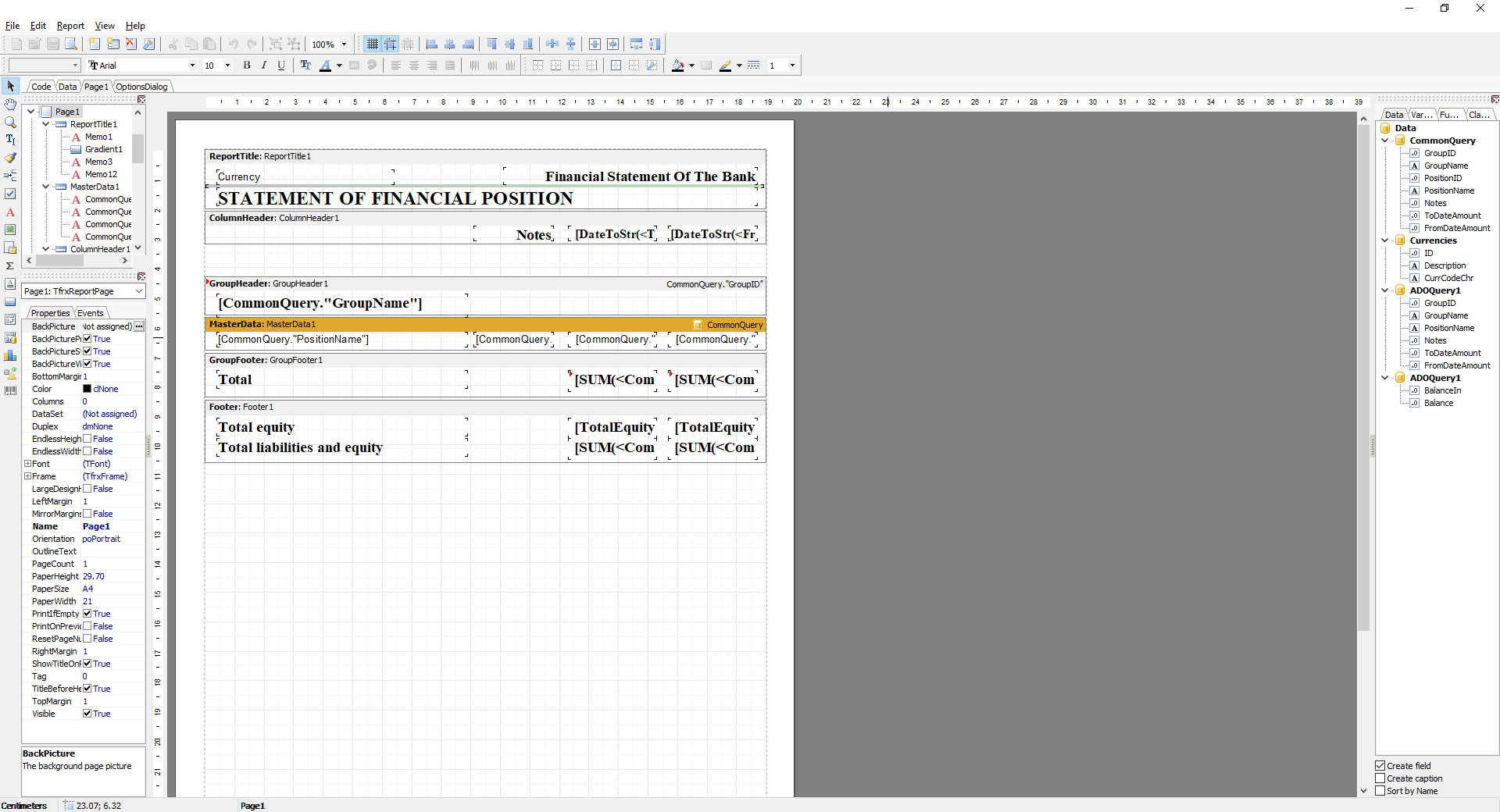

Canopus EpaySuite

Solution focused on complex automation of payment institutions,

corresponding to RTS PSD 2 and GDPR.

Canopus Remittance

Solution for automation of retail money transfer systems.

Canopus Treasury

Solution to consolidate financial flows and control liquidity of a group of companies.

Canopus OTP/Mac Generator

Application for generation of personal time-sensitive one-time passwords, or on the basis of payment data.

Canopus Connect

Public payment services: acceptance of payments in behalf of service providers.

Canopus Crypto

Solution for crypto currency exchange offices, crypto-exchanges and ICO projects.